Apple Mired in the AI Quagmire: The Innovation Dilemma of a $3 Trillion Giant

In July 2025, as Google's Gemini and Huawei's Pangu race ahead in the AI arena, Apple's China-specific AI remains mired in development hell. On the eve of WWDC26, engineers are scrambling to meet the data localization requirements of China's "Generative AI Service Management Measures" while simultaneously fielding inquiries from the U.S. Congress regarding its China collaborations.

This tech giant, which once redefined smartphones with the iPhone, has seen $630 billion wiped from its market cap in six months, with its stock price down 18.1% year-to-date. Apple's AI strategy is caught in a perfect storm spanning technology, management, and geopolitics.

Management Turmoil and Internal Strife Cripple AI Progress

In March 2025, a rare high-stakes power struggle unfolded at Apple headquarters. CEO Tim Cook made a decisive move: replacing AI chief John Giannandrea and transferring Siri control to Vision Pro hardware head Mike Rockwell. This leadership change wasn't isolated. By late April, Giannandrea's authority was further eroded, losing oversight of even the secretive robotics division. This double demotion within a month laid bare deep-seated anxiety within Apple's leadership over its AI strategy.

Organizational infighting is eroding innovation efficiency:

- Software chief Craig Federighi's long-held view that "AI is not a core device function" has led to chronic underinvestment.

- Hardware divisions, citing cost control, refused to expand AI chip capacity. As a result, the 30-billion-parameter model only runs on devices with 8GB+ RAM, instantly excluding 60 million legacy users.

- Internal resource battles have devolved into departmental warfare, with teams allegedly inflating project ROI to secure computing resources.

Compounding this is a talent exodus. Meta poached foundational model lead Ruoming Pang with a $200 million offer, a figure Apple couldn't match. Over the past year, 11 senior AI executives have been lured away by rivals like OpenAI. Employees privately criticize the company for operating "like a family business."

Strategic Missteps: The Cost of Conservatism

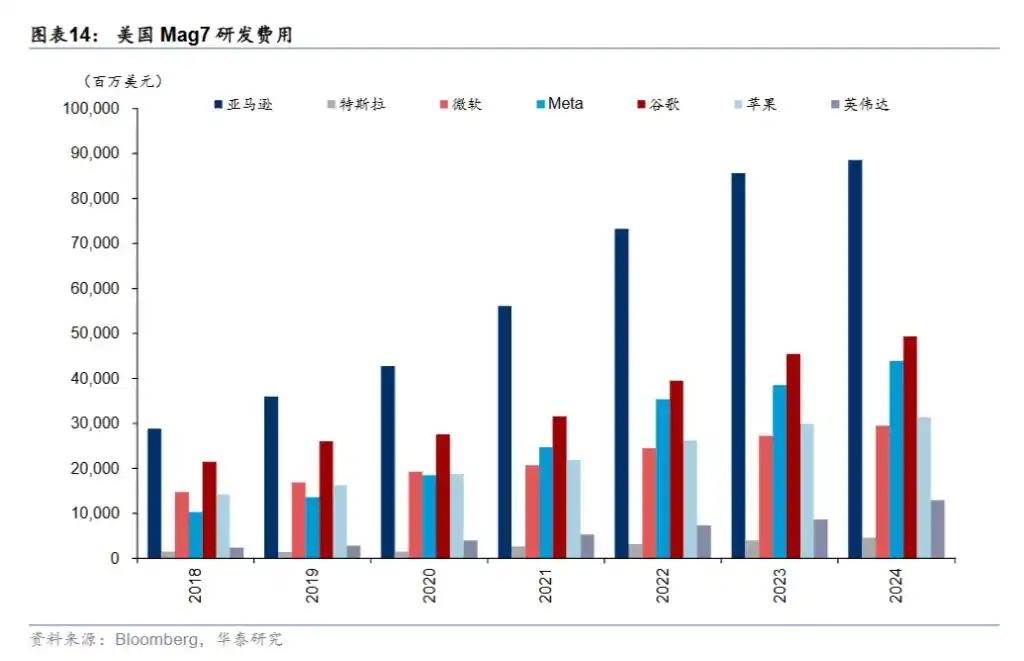

While Microsoft invested in OpenAI in 2019 and Google acquired DeepMind, Apple remained complacent in its hardware profit haven. 2023 financials revealed hardware contributed 78% of revenue, while R&D spending stood at just 5.8% – less than half of Google's 15.4%.

This financial conservatism has backfired:

- Cook's tenure saw over $600 billion in stock buybacks, while AI M&A spending remained under $10 billion.

- The $10 billion saved by abandoning Project Titan wasn't redirected to AI.

- 2023's AI budget of $2.8 billion was a quarter of Google's annual investment.

Technical choices reveal path dependency

The "unified aesthetic" bringing iOS26's design language closer to visionOS was criticized by analysts as a smokescreen for inadequate AI performance. While Microsoft deeply integrated GPT-4o into Windows, Apple debated whether to integrate third-party models.

Users pay the highest price. Restricting AI features to iPhone 15 and newer instantly excludes 700 million legacy device users globally, disproportionately impacting elderly users reliant on smart tech. The "#SeniorPhoneCrisis" trend highlights how younger users now remotely assist parents with third-party AI apps.

Geopolitics: Compliance Quagmires Across the Pacific

The challenges in China are particularly acute. Among the 8 large models approved by the Cyberspace Administration of China (CAC), Alibaba's Tongyi Qianwen and Baidu's Ernie Bot are included, yet Apple has failed to secure partnerships with any domestic model.

The core conflict lies with Article 19, Chapter III of the "Generative AI Service Management Measures," mandating all training data be stored domestically. This fundamentally clashes with Apple's on-device AI architecture – its differential privacy framework requires local data processing, while Chinese models necessitate uploading user queries to the cloud for content filtering.

Content censorship poses further hurdles. Engineer testing revealed queries like "Taiwan travel guide" trigger standardized responses from Chinese models, conflicting with Siri's global unified response strategy. The dual constraints of data sovereignty and content control doomed plans for direct integration.

Political Pressure Creates a Double Bind

- Leaked documents seen by Bloomberg show China's Apple Intelligence faces a triple downgrade: 40% drop in personalized recommendation accuracy, pre-installed filters for text-to-image features, and forced substitution for sensitive location semantics.

- The White House scrutinized the Alibaba collaboration, demanding clarification on potential tech transfer.

- Trump-era 54% tariffs on China threaten supply chain costs for the 90% of iPhones still made there.

R&D Spending Trapped in a Snowball Effect

Apple's R&D budget is caught in diminishing returns. Its FY2024 report shows a massive $31.4 billion (~¥227 billion RMB) R&D spend – up 5% YoY, representing 8% of revenue. This equates to burning $86 million daily, yet yielding scant innovation breakthroughs.

After years of investment, Apple terminated its electric "Project Titan" in 2024 and repeatedly delayed AI feature rollouts, failing to close the gap with OpenAI and Google. This signals a clear decline in R&D conversion efficiency, symptomatic of an industry leader prioritizing mature profit models over disruptive innovation.

(Image Source: Bloomberg, Taihua Research)

(Image Source: Bloomberg, Taihua Research)

Radical Measures: Apple's AI Survival Strategy

Investor patience is wearing thin. Shareholders are pressuring Apple to break tradition and accelerate AI deployment via acquisitions. Last month, Apple executives secretly discussed acquiring the $14 billion-valued AI search engine Perplexity AI. Wedbush analysts noted even a $30 billion purchase would be "a drop in the ocean" for Apple's $133 billion cash pile.

Internal reforms are underway:

- Consolidating robotics R&D under hardware veteran John Ternus.

- Developing a standalone China tech stack, despite adding $230 million in annual costs.

- Adjusting EU iOS warning pop-ups to circumvent digital tax risks.

A technical compromise emerged for China: a "glued-together AI" architecture using Ernie Bot as the core cloud engine with Alibaba handling content compliance. However, this patchwork solution significantly degrades functionality. China pre-order data shows iPhone Pro orders down 12% YoY.

Apple's predicament reflects a new paradox of tech globalization. As data sovereignty becomes an inviolable red line, even a $3 trillion giant must accept the reality of "one world, two systems." Cook's team stands at a crossroads: acquiring Perplexity AI could be a strategic inflection point, while the final form of its China-specific AI will determine its ability to defend its position in the world's largest smartphone market.

The warning from research firm MoffettNathanson echoes over Cupertino: "Failure to rebalance commercial interests and societal responsibility could see Apple follow Nokia's path." As Vision Pro's virtual interface fails to mask its AI innovation deficit, Apple needs more than management reshuffles – it requires a genetic-level reinvention to embrace the intelligence revolution.