SoftBank's $2 Billion Injection into Intel: Can the Chip Giant Stage a Comeback?

On August 18, 2025, Tokyo and California simultaneously announced that SoftBank Group would subscribe to Intel's newly issued common shares at $23 per share, with a total investment of $2 billion. Following the announcement, Intel's stock price surged 6% to $25 in after-hours trading.

Upon completion, SoftBank will hold approximately 1.8% of Intel's shares. Chairman Masayoshi Son stated in the declaration: "Semiconductors are the foundation of every industry."

Intel's recent struggles have become an industry focus. In 2024, its stock plummeted 60%. Despite an 18% rebound in 2025, its foundry business... recorded a net loss of $2.9 billion in Q2, with a capacity utilization rate below 60%. Intel consistently missed the AI boom, prompting newly appointed CEO Lip-Bu Tan to initiate restructuring: shutting down the automotive chip division and planning 15%-20% job cuts in the foundry unit.

SoftBank's investment aligns tightly with its global AI strategy. Son committed to "invest $100 billion in the U.S. within four years", making this Intel stake a critical piece. The group previously invested $30 billion in OpenAI and co-led the $500 billion "Stargate" data center project.

Market attention centers on synergy potential between SoftBank-owned Arm and Intel. Arm architecture holds 90% market share in mobile processors. "Post-investment, Intel could become Arm’s preferred foundry partner for custom chips," analysts note. Arm plans to develop... proprietary chips, while Intel urgently needs anchor customers to boost utilization rates.

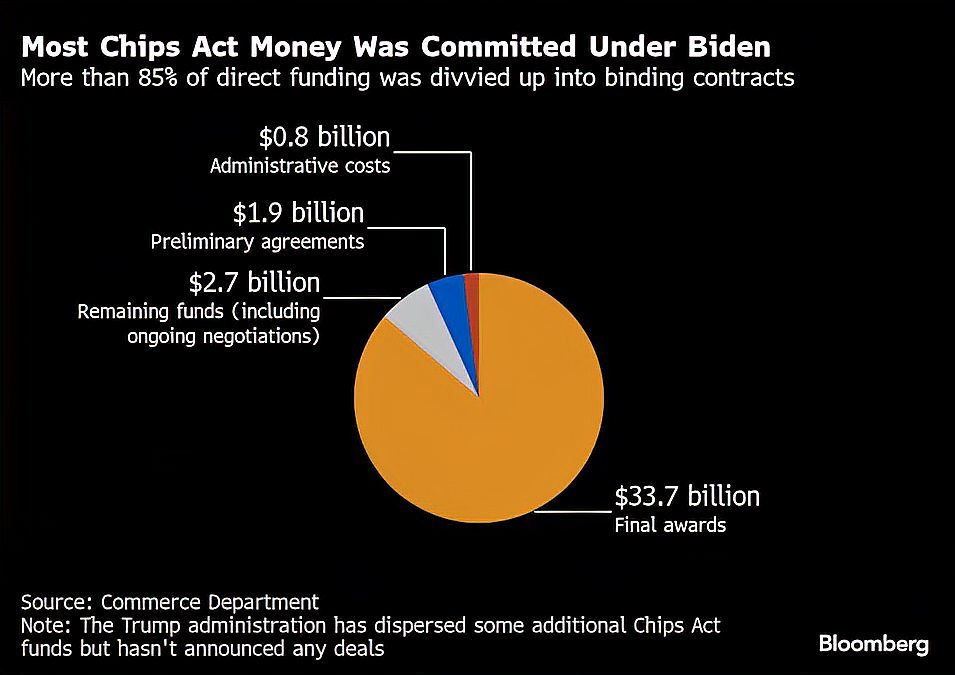

Concurrently, the Trump administration plans to convert $7.9 billion in CHIPS Act grants into equity, targeting a 10% stake. This would create a "private-public rescue alliance". Intel, as America’s sole advanced-node IDM (Integrated Device Manufacturer), has been designated a "national strategic asset".

Global semiconductor geopolitics adds complexity. Son explicitly endorsed U.S. policy: "This investment reflects confidence in expanded U.S. advanced semiconductor manufacturing..."—showcasing SoftBank’s unambiguous "America First" strategy.