Breakthrough Year: China's Domestic AI Computing Share Surpasses 65%, Reshaping Global Landscape with ¥100B Market

How to Quantitatively Assess the Scale of China’s AI Computing Power Demand?

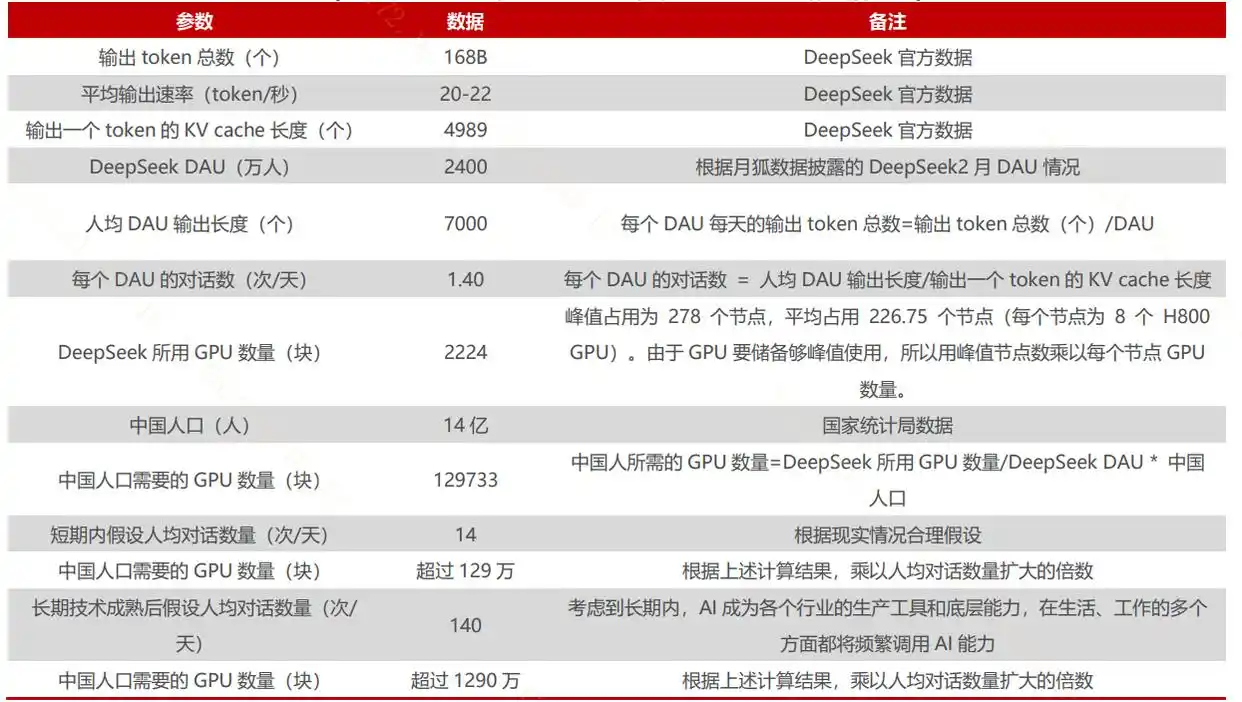

Based on the paper "Overview of DeepSeek-V3/R1 Inference System," assuming constant monthly active users with each user sending just 1.4 messages per day, China’s long-term GPU demand for AI computing power would exceed 12.9 million units according to its population size.

Estimates show that the current GPU capacity held by major domestic cloud providers is only ~10% of North America’s, while China’s potential AI user base is 3–4 times larger. This supply-demand imbalance presents long-term investment opportunities for domestic computing power.

(Source: China Securities – Estimation of Domestic GPU Demand)

(Source: China Securities – Estimation of Domestic GPU Demand)

I. Policy Direction: Clear Localization Targets, Accelerated Local Implementation

In late 2023, China’s MIIT and five other ministries issued the Action Plan for High-Quality Development of Computing Infrastructure, mandating that by 2025:National computing capacity exceed 300 EFLOPS,Intelligent computing power comprise 35% of the total,Full-stack independent controllability be a core objective.

Local governments swiftly followed:

- Beijing: Targets 100% self-developed intelligent computing infrastructure by 2027.

- Shanghai: Requires >50% domestic chips in new AI data centers by 2025.

- Hangzhou: Allocates ¥250M annually in "computing power vouchers" to subsidize cloud adoption.Driven by policy, domestic AI computing power’s market share surged from 28% (2022) to 65% (2025), with Huawei’s Ascend ecosystem leading at 40%.

II. Demand Surge: Three Sectors Fueling a ¥100B Market

Explosive growth in downstream applications is exponentially boosting demand:

- 1.Internet & Telecom:Alibaba & Tencent’s Capex soared 304.85% YoY and 225.5% YoY in Q1 2024, prioritizing AI infrastructure.China Mobile’s ¥19.1B intelligent computing center procurement set an industry record; China Telecom & Unicom launched >¥10B projects each.

- 2.Government AI Centers:New projects grew 67% YoY in 2024, averaging >¥1B investment per project.

- 3.Enterprise Adoption:42% of finance/manufacturing firms are testing LLMs; AI risk systems now respond in ≤3 seconds.IDC Forecast: China’s AI computing market will exceed ¥100B by 2025 (50% CAGR).

III. Technological Breakthroughs: From "Usable" to "Competitive"

Domestic chips are advancing faster than expected, rivaling global benchmarks:

- Chip Performance:Huawei Ascend 910B deployed at scale in government/telecom sectors.Cambricon Siyuan 590: 200% faster training vs. predecessor.Hygon DCU supports CUDA-like ecosystem, reducing migration costs.

- Energy Efficiency:Liquid cooling adoption >60%; power density per rack 3× higher vs. 2022.3nm chips boost computing unit efficiency by 40%.

- Architecture Innovation:Chiplet heterogeneous integration breaks Moore’s Law limits.1.6T optical modules enable μs-level latency, enabling compute-storage separation.

IV. Capital Momentum: Domestic Computing Chain at Investment Forefront

Market confidence is reflected in capital flows:

- Primary Market:Alibaba: ¥380B commitment over 3 years for AI infrastructure.Chinasoft: Raised ¥3.38B for Beijing-Tianjin-Hebei innovation base & Huailai computing center.

- Secondary Market:AI computing stocks’ total market cap hit ¥2.76T, adding >¥1T since 2023.

By 2025, China’s AI computing battlefield will evolve from "import substitution" to defining the standards. One message is clear——Computing sovereignty is becoming the ultimate trump card in global tech competition.